Accounting Firm in Peru: Comprehensive Services for Foreigners

- David Lynch

- 20 sept 2024

- 2 Min. de lectura

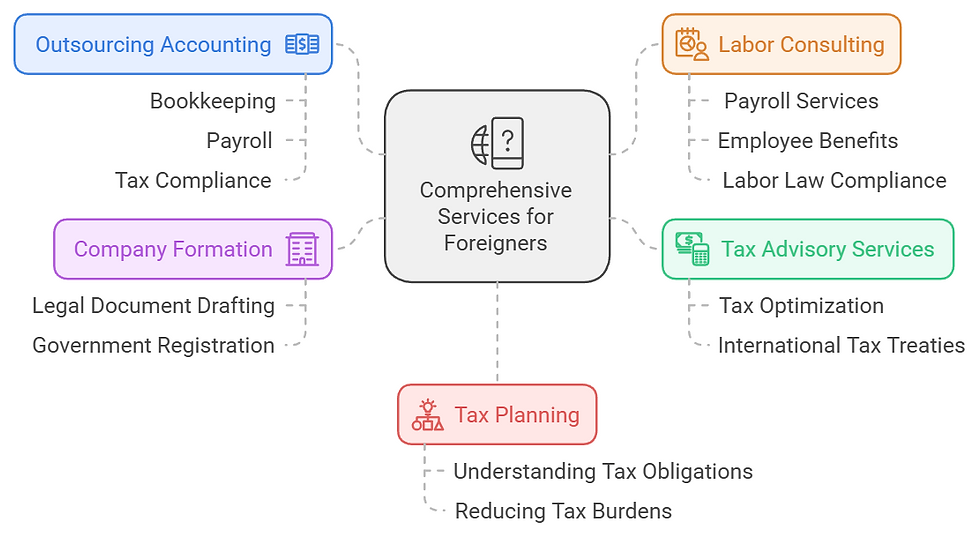

At Lynch & Associates SAC, we provide professional accounting services in Peru for foreign companies and individuals looking to establish or expand their businesses. Our firm is recognized for its expertise in Outsourcing Accounting, Tax Advisory, Labor Consulting, Company Formation, and Tax Planning. We hold the prestigious Leader League certification, showcasing our commitment to excellence in the field. You can view our certification at Leader League.

Why Choose Us?

International Expertise

Our team specializes in cross-border tax services and is well-versed in handling the complexities of international tax laws. We provide comprehensive tax advisory services for U.S. citizens and foreign residents living or operating in Peru, ensuring that they stay compliant while optimizing their tax situations.

Peruvian CPA for Expats

Whether you're an expatriate needing assistance with U.S. tax preparation in Peru, or a company looking for an accounting firm that understands U.S. tax regulations, Lynch & Associates SAC has the experience and knowledge to assist you.

Outsourced Accounting for U.S. Businesses

We offer outsourcing accounting services in Peru for foreign companies looking to streamline their operations. Our services include payroll services in Peru for foreign companies, ensuring compliance with local labor laws while maintaining efficiency in your business processes.

Tax Optimization & Planning

We specialize in international tax services, helping businesses and individuals minimize their tax liabilities both locally and internationally. Whether it’s navigating the complexities of Peruvian tax law or ensuring compliance with international tax treaties, we help you optimize your finances.

Our Key Services

Outsourcing Accounting

Let us handle your company's financial management. We offer full-service outsourced accounting solutions that cover bookkeeping, payroll, and tax compliance. Our team ensures that your company meets local regulations while saving you time and resources.

Tax Advisory Services

Taxation can be complicated, especially for foreigners or foreign businesses operating in Peru. Our tax advisory services help you navigate Peruvian tax laws and international tax treaties. We assist with tax optimization, minimizing liabilities while ensuring compliance with local authorities.

Labor Consulting

Managing employees and payroll in a foreign country can be daunting. Our labor consulting services include payroll services, employee benefits, and labor law compliance. We help ensure that your company follows Peru’s labor regulations, mitigating risks and optimizing payroll processes.

Company Formation in Peru

Looking to expand into the Peruvian market? We guide you through the entire company formation process. From drafting legal documents to registering with government authorities, Lynch & Associates SAC makes the process seamless and efficient.

Tax Planning for Foreigners

Tax planning is essential for reducing tax burdens while maintaining compliance. Our experts in international tax services ensure that you understand your tax obligations both in Peru and abroad.

Contact Us

Whether you are seeking accounting firm in Peru, need help with tax advisory, or are ready to start your business in Peru, Lynch & Associates SAC is here to help. Contact us at www.lga.pe for a free consultation today.

![Equivalentes de la SUNAT en Latinoamérica y el mundo [2025]](https://static.wixstatic.com/media/44540e_3f9b947ef78a42489b2456ca0007a557~mv2.jpg/v1/fill/w_900,h_600,al_c,q_85,enc_avif,quality_auto/44540e_3f9b947ef78a42489b2456ca0007a557~mv2.jpg)

Comments